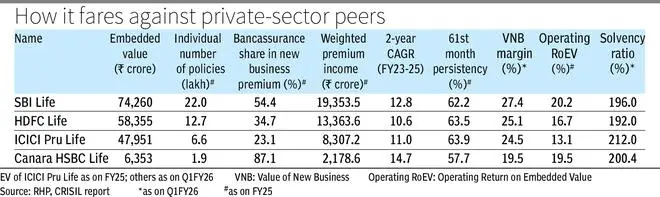

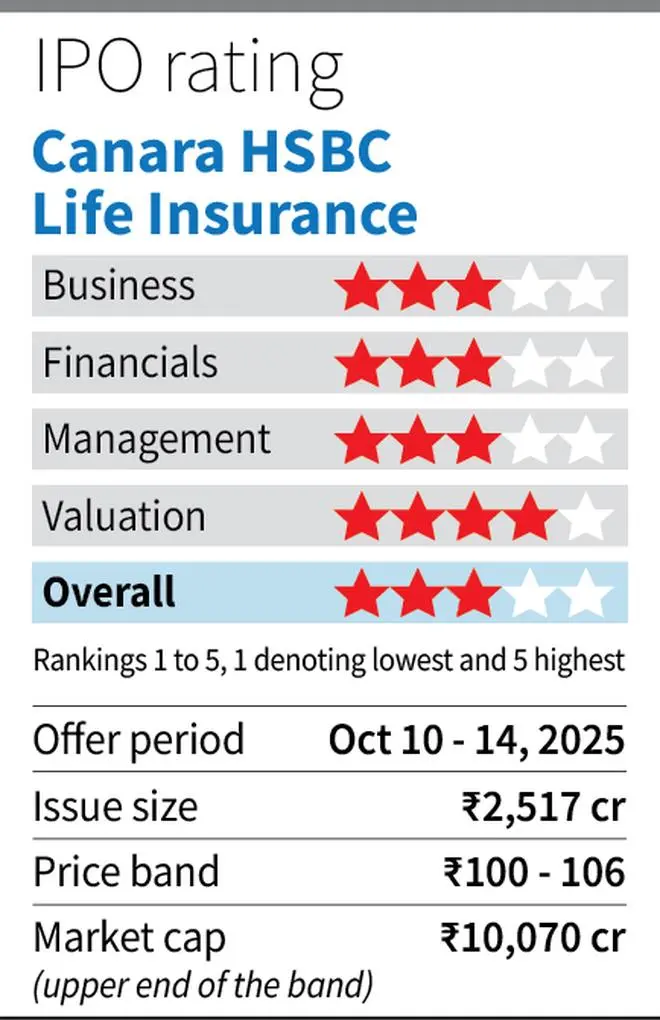

India’s private life insurers continue to command rich valuations, yet Canara HSBC Life, which is tapping the market with a ₹2,517-crore offer-for-sale closing on October 14, sits at the bottom of the range. Valued at about 1.6 times its Q1FY26 embedded value, Canara HSBC Life, at its upper price band of ₹106, trails SBI Life (2.4x) and HDFC Life (2.8x), and is even cheaper than Max Financial Services (2.1x) or ICICI Prudential Life (1.8x). That discount of 10-45 per cent versus peers looks tempting, but it also signals the uneven quality within India’s private life-insurance landscape.

That said, Canara HSBC Life’s low valuation itself answers many investor questions — it reflects the company’s smaller scale and limited franchise. Hence, only long-term investors with a five-to-seven-year horizon may consider subscribing to the offer, as any re-rating is likely to be gradual.

The 17-year-old life insurer’s promoters, Canara Bank and HSBC Insurance Holdings, and investor PNB are altogether selling 23.75 crore shares or 25 per cent stake to the public. Post the public issue, promoters will continue to hold 62 per cent in the firm, while PNB will retain 13 per cent.

Though Canara HSBC Life will be the sixth company from its industry to get listed, investors need to understand what drives long-term value in life insurance, given that the business often looks complex. Profits emerge gradually, with expenses front-loaded and valuations tied to embedded value rather than near-term earnings.

The basic model

Life insurers collect single or periodic premiums, which are invested to generate returns. The margins differ by segment: Participating (Par) policies share investment surplus with policyholders, non-par plans offer fixed benefits and retain investment gains/losses, ULIPs earn fund management fees, while annuities depend on long-term interest rate spreads.

These policy premiums are invested and generate investment income. Claims, commissions and expenses are paid out; what remains is the surplus (profit). Part of this surplus enhances embedded value (EV), which is a measure combining net worth and present value of future profits from existing policies.

For a life insurer, ULIPs are volume-driven and cyclical; non-par products deliver steady, high margins; participating plans are stable but lower margin; annuities are long-duration and rate-sensitive.

Profitability in life insurance rests on a few levers. They include steady growth in new business, high persistency of policy renewals, a favourable product mix tilted towards non-par and annuity plans, broad distribution reach, stable investment returns and a healthy solvency ratio above the regulatory floor.

Typically, stock market participants value insurers on Price to Embedded Value (P/EV). High P/EV is usually for strong brand, persistency, scalability (for example, HDFC, SBI Life). Low P/EV could mean weak growth visibility or narrow franchise. EV growth and VNB (value of new business) margins are leading indicators of future valuation.

Where it stands

Investors typically assess life insurers on growth, persistency, product mix, distribution reach, investment performance and solvency.

Canara HSBC Life is among the smaller private-sector insurers, with a FY25 market share of 1.81 per cent in terms of individual weighted premium income (WPI). This is in stark contrast to other listed bank-led insurers SBI Life (16.1 per cent), HDFC Life (11.1 per cent), Axis Max Life (6.92 per cent) and ICICI Pru Life (6.9 per cent).

Backed by foutth-largest PSU lender Canara Bank, the company has a strong parentage and this ensures access to a large 15,700+ overall bancassurance branch distribution network. To its credit, the company posted faster growth in WPI and renewal premiums in FY23-25 period as well as FY25 compared to peer set (SBI Life, HDFC Life, ICICI Pru Life). Product distribution is almost entirely bancassurance-led (FY25: 87 per cent); limited agency or digital diversification restricts scalability. Even within bancassurance, productivity is modest — ₹21 lakh in premium and 16.8 policies per branch, against a 10-peer average of ₹51 lakh and 38 policies. This points to under-leveraged potential within a large partner network.

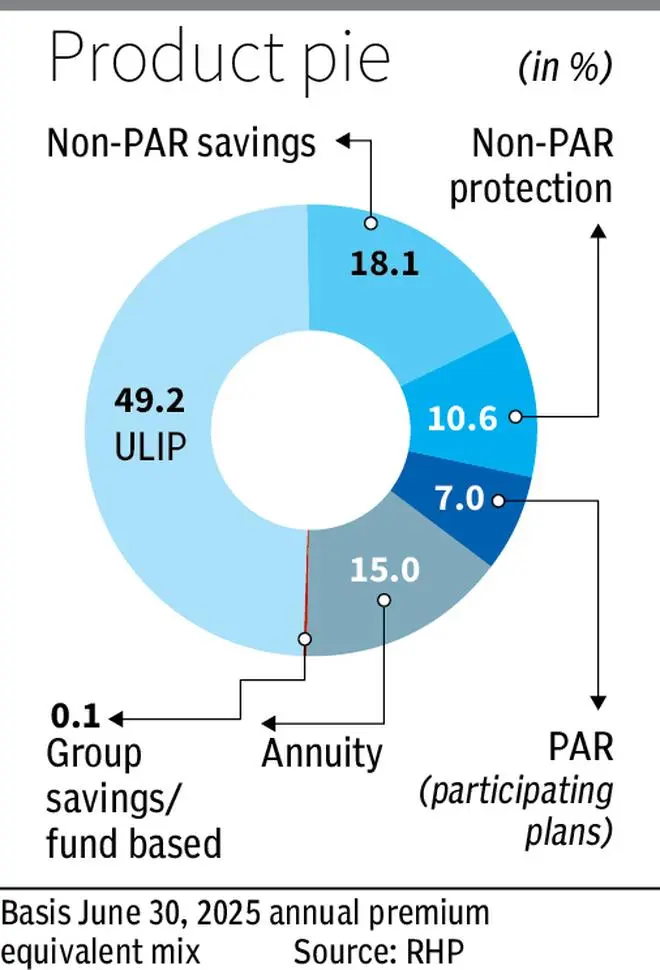

Its portfolio encompasses 20 individual products, seven group products, and two optional rider benefits, along with policies under the PMJJBY scheme. In terms of product mix, ULIPs form nearly half of annual premium equivalent (APE), non-par savings 18 per cent, non-par protection at 7 per cent and annuity 15 per cent. The mix is broadly similar to some peers but smaller non-par protection share could be impacting VNB margin at 19.5 per cent vs. over 25 per cent for the peer set. Expanding the non-par protection and annuity share could meaningfully lift margins and embedded-value growth.

Canara HSBC Life sports persistency ratio of 82.5 per cent (13th month) and 57.7 per cent (61st month) for FY25. This is lower than peer set (85 per cent/86 per cent and 62 per cent/63 per cent). This indicates relatively higher lapse rates — customers discontinue earlier, hurting long-term profit recognition.

In terms of profitability, the company posted flattish PAT growth in FY25 and this has also meant that its growth for FY23-25 period is also the weakest among peer set. However, its track record of profitability for 13 consecutive years is encouraging. FY25 yields of 7-8 per cent highlight decent investment income; the drag lies more in operating scale than portfolio returns. Canara HSBC Life has the third-highest assets under management (AUM) among PSU bank-promoted life insurers, though its overall scale remains modest at about 9-12 per cent of the peer set.

The company’s operating expenses-to-gross written premium (GWP) ratio at 12.4 per cent in FY25 is well above peers — HDFC Life (8.8 per cent), ICICI Pru Life (8.1 per cent) and SBI Life (5.3 per cent). Higher cost ratios usually reflect either weaker scale, greater dependence on high-commission channels, or limited operating leverage; if business volumes expand meaningfully, costs are likely to trend lower.

The company’s solvency ratio, a measure of its ability to meet policyholder obligations, has consistently remained above the regulatory minimum of 150 per cent. But it has trended downward over the last three years, from 251.8 per cent in FY23 to 205.8 per cent in FY25, and further to 200.4 per cent in Q1FY26. The decline has primarily been driven by rising new business volumes and a shift in product mix. This metric warrants monitoring.

Key takeaways

The valuation discount largely mirrors Canara HSBC Life’s smaller-scale, narrower product mix, and higher operating cost base. While profitability and solvency remain decent, growth visibility is moderate amid tough competition.

The company’s prospects hinge on deeper cross-selling within Canara Bank and HSBC’s network and a broader non-par product suite. But heavy reliance on a single channel, limited digital presence and low brand recall are constraints.

The life insurance sector enjoys structural drivers such as financialisation of savings and low penetration (CY23: 2.8 per cent) compared to global averages. It enters the second half of FY26 on a positive note — the GST waiver, while causing short-term margin pressure from the loss of input tax credit, should aid long-term penetration; a likely rate-easing cycle could also support non-par and annuity growth. In addition, the proposed 100 per cent FDI under automatic route, potential composite licences for product expansion and ongoing digital initiatives are expected to deepen reach among younger and tier-II market customers.

That said, valuations of private-sector leaders are rich. Hence, smaller players trade at discounts offering catch-up potential over the long term if things improve. At a relatively-lower valuation, downside risk, of course, remains limited for Canara HSBC Life. But upside potential will be gradual. Though not strictly comparable, insurance behemoth LIC’s 2022 issue came at 1.1x P/EV, and the stock now trades below its offer price, a reminder that valuation comfort alone doesn’t guarantee stock gains.

Published on October 11, 2025