Of all the financial products out there, it is health insurance that causes the most heartburn. Write anything on health insurance, and you instantly get scores of reactions from angry folk who are unhappy with their health insurance experience or have had their claims stonewalled by the insurer.

However, in insurance more than in other financial products, knowing the law helps you protect your interests. Awareness of important regulations governing health policies helps you choose the right policy, understand what it can and cannot deliver, help you file a water-tight claim and even win you a favourable award from the Insurance Ombudsman, if disputed.

But getting acquainted with the law governing health insurance is not easy, as it requires reading through the several regulations, circulars and guidelines issued by the IRDAI (Insurance Regulatory and Development Authority of India) over the years. This is why we decided to do the reading for you and have distilled the most important regulations that health insurance buyers should know. Here, we not only simplify health insurance regulations that you may not know, but also spotlight the escape clauses that insurers may use to wriggle out of their promises.

Covers necessary hospitalisation

Never mind what the advertisements say. One of the first things to know when buying a health policy, is that it won’t protect you from all kinds of health emergencies or reimburse all types of medical expenses. Health insurance plans in India are hospitalisation indemnity plans. They reimburse you only for expenses incurred on medical conditions that need hospitalisation. To avoid a rude shock at the claims stage, it is good to know the official definition of “hospitalisation”. Here’s the definition from IRDAI’s Master Circular on Standardisation of Health Insurance Products.

Hospitalisation: It means admission in a hospital for a minimum period of 24 consecutive ‘in-patient care’ hours, except for specified procedures/ treatments where such admission could be for a period of less than 24 consecutive hours.

This definition tells you that, normally, to be eligible for insurance payouts, you should be admitted into a hospital for 24 hours without a break. You should be receiving treatment (and not just taking a well-earned rest). If you bumped your head and were in the emergency ward for ‘observation’ for a day, that won’t count as hospitalisation.

Escape clause: There are scores of real-life cases where health claims get thrown out even after the patient spent 24 hours in a hospital. This is because of the condition that insurers will only pay for “medically necessary treatment” during hospitalisation. Here’s how IRDAI’s Master Circular defines this.

Medically necessary treatment: Any treatment, tests, medication or stay in hospital, which is required for medical management of illness or injury suffered by the insured. It must not exceed the level of care necessary to provide safe, adequate and appropriate medical care in scope, duration or intensity. It must be prescribed by a medical practitioner and must conform to the professional standards widely accepted in international or Indian medical practice. This clause also means that the insurer is liable to pay only the costs absolutely necessary to treatment. Hospital registration fees, food provided to attendants, extra tests done at the patient’s request etc, will not be reimbursed.

Therefore, to file a successful claim, you need a) a clear prescription from a doctor that you need hospitalisation and a certain medical treatment; b) 24-hour continuous stay in the hospital, with proof of receiving medical treatment during it; c) bills showing that you didn’t get VIP treatment and only got usual treatment. Tall ask, yes, but that’s how it is!

Often, surgery or procedures at a hospital entail medication, tests or treatment, both before and after hospitalisation. Many health policies cover these pre- and post-hospitalisation expenses for limited periods such as 15 days to a month. However, do note that any claims of pre- or post-hospitalisation expenses need to be related to the specific ailment for which you got admitted at the hospital. If you got admitted for a gall bladder surgery and took a MRI of your brain before admission, the insurer will not easily pay it unless you can prove this was related to the surgery.

PEDs: When in doubt, disclose

Young folks like PDA (public display of affection), insurers love PEDs. PEDs or pre-existing diseases are one of the biggest bones of contention in insurance contracts. Your health policy is not worth the paper it is written on, if you miss out on disclosing PEDs.

When listing out our ailments at the application stage, many of us wonder what we should include and what we should leave out as PEDs. Should you mention that you had chicken pox in the 5th standard and Hepatitis B in college? Should you mention your wrist fracture 10 years ago when you had an orthopaedic plate implanted? This becomes clear from IRDAI’s Master Circular, which defines PED like this.

Pre-existing disease (PED): Any condition, ailment, injury or disease diagnosed by a physician within 48 months prior to the effective date of the policy issued by the insurer. Any condition or illness for which medical advice or treatment was recommended by or received from a physician within 48 months prior to the effective date of the policy or its reinstatement.

The first part clearly tells you that when listing out PEDs, you should not leave out any illness, accident or treatment however minor in the four years leading up to your health insurance application. But don’t forget the second line, or you will come to grief.

Escape clause: Did you have an ailment or health condition in your childhood or teenage, which left a lasting impact on your body or bothers you sometimes? Do mention such conditions under PED too, though they may be ancient history. Any chance mention of a past condition by your doctor in a prescription automatically turns into a PED for your health insurance. Therefore, even if your wrist fracture is 10 years old, you do need to include it in PED as you still have the implant.

If you skip mentioning any such instance in your application, this can lead to your claims being rejected for non-disclosure, even during a completely-unrelated treatment. In one case flagged by the insurance ombudsman, Mr P had his ₹5 lakh claim for angioplasty denied, because he had failed to include childhood psoriasis (a common skin condition) in his PED disclosures. Mr P suffered from psoriasis 30 years ago, but his doctor mentioned it in a recent prescription making it an official PED which he failed to disclose!

Reporting your PEDs diligently when first applying for insurance, is important for your waiting period calculation too. The waiting period is the initial period in your health policy after which treatments relating to PEDs don’t get reimbursed. IRDAI caps the maximum waiting period that insurers can impose at three years. However, if you fail to report a PED at the beginning and the insurance company discovers it later, it can either cancel your policy, or restart the waiting period clock on the PED that you just disclosed.

Moratoriums are not fail-safe

Finding that insurers were turning away too many claims, IRDAI has embedded a ‘moratorium’ clause into both health insurance and life insurance products. IRDAI’s May 2024 Master Circular on Health Insurance says this: No policy and claim of health insurance shall be contestable on any grounds of non-disclosure or misrepresentation, after the completion of the moratorium period which is 60 months of continuous coverage. After the expiry of moratorium period, no health insurance policy shall be contestable except for proven fraud and permanent exclusions specified in the policy contract. Accrued credits under ported and migrated policies shall be counted for the purpose of calculating the moratorium period.

This is a very useful thing to know because if you have kept a health policy alive for 60 continuous months, the law says that the insurer cannot frivolously turn down your claim. This is a strong incentive to take a good health insurance policy early and keep renewing it, rather than constantly discontinuing plans and switching. However, to legally claim protection under moratorium, you need to fulfil three conditions.

* You should have initiated the policy five years ago and renewed it every year without a break

* You should have paid the premiums within grace period so that your cover never got interrupted

* If you want to change policies, migrate within the same insurer or opt for porting. This way, you get credits for the moratorium period you already completed with your old insurer/policy for calculation of 60 months

Escape clause: While insurers cannot turn down your entire claim once you complete the moratorium, they can settle only part of your bill. They can also turn down claims based on policy exclusions, which lurks in the fine-print. The moratorium also goes out of the window if the insurer is able to prove that you have committed fraud. The definition of fraud under IRDAI regulations is quite sweeping.

Fraud is any act or omission intended to gain advantage through dishonest or unlawful means including but not limited to: Misappropriating funds, deliberately misrepresenting/concealing/not disclosing one or more material facts relevant to any decision / transaction, financial or otherwise, abusing responsibility, position of trust or a fiduciary relationship.

While some parts of this definition refer to insurance officials or intermediaries, misrepresenting, omitting or concealing material facts when you sign up for a policy also qualifies as fraud. That brings us right back to PEDs and disclosing every scrap of information about our health history when applying for a policy. Insurers also secretly share data on fraud with each other. Therefore, if you are blacklisted by one insurer, that can count against you all your life with other insurers.

Know exclusions by-heart

The fine-print in insurance contracts is not only difficult but also depressing to read, because it lists out medical conditions you haven’t even heard about. Unfortunately though, you skip the exclusions section at your own peril.

Earlier, individual insurers made their own rules on what diseases they would cover and what they would exclude. This made life difficult for policy buyers who had to go over the fine-print with a magnifying glass. But IRDAI’s 2019 Guidelines on Standardisation of Health Products have listed out a set of health conditions that insurers cannot exclude from their policies. The accompanying table 1 has the details.

The guidelines say that insurers cannot exclude mental and psychological disorders, artificial life support where the patient has some hope of recovery, menopause-related treatment, behavioural and neuro disorders, genetic and congenital disorders, mental impairment resulting from prescribed medicines etc from coverage.

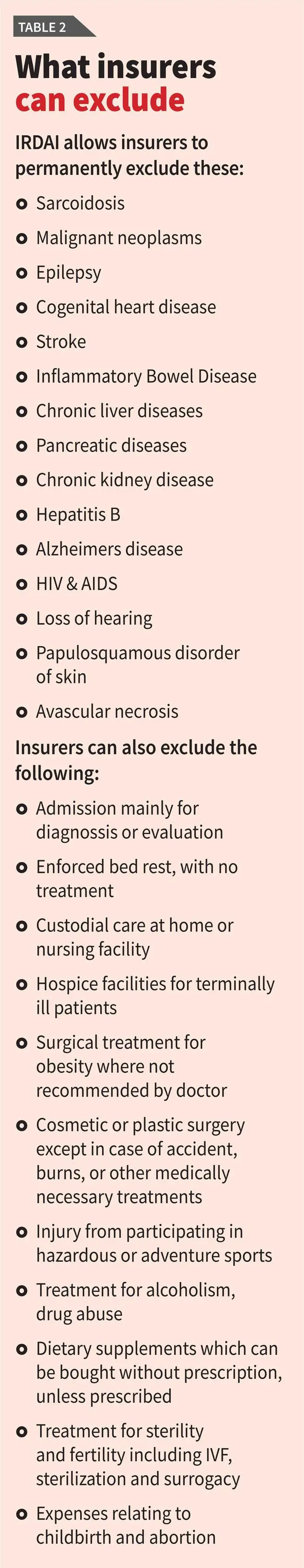

Escape clause: While preventing insurers from excluding the above conditions, IRDAI explicitly allows them to refuse cover for many conditions too, based on their internal underwriting policy.

As table 2 shows, IRDAI allows insurers to permanently exclude certain conditions, irrespective of whether they are PEDs or not. This list has common conditions such as IBS, Alzheimer’s and epilepsy, and life-threatening ones such as Chronic Kidney and Liver disease, and stroke. If you are susceptible to these conditions, do evaluate whether it makes sense to take insurance at all, without this coverage.

Insurers can also not give you cover if you are admitted for observation or bed rest without treatment, if elders need nursing care or attendants to help with their daily activities or if the policy buyer needs palliative care. Common treatments for childbirth, abortions, miscarriages, fertility, IVF etc can also feature as exclusions. Therefore, if you plan to take up such treatments, do check your health policy to plan accordingly. Insurers can also exclude bariatric surgery except when recommended by a doctor, cosmetic surgery (except in accidents), treatment for injuries from adventure sports, illegal activities, drug abuse etc.

Claims don’t affect premium, renewals

Vexed that the insurer is making you jump through several hoops before issuing your health policy? Well, you need to go through this torture only once.

IRDAI’s Master Circular on Health Insurance, May 2024, says that once you have a live health insurance plan, the insurer has to compulsorily renew it at the end of the term whether one year or three years, if the product is not withdrawn. The insurer also cannot refuse to renew your insurance cover on the grounds that you made claims in the previous years. In fact, an insurer can re-evaluate your policy only when you ask for an increase in cover. In such cases, the insurer can refuse to increase the cover but cannot turn down renewal of your existing policy.

What if you want to cancel a health insurance policy midway because you are unhappy with it? The Master Circular on Health Insurance, May 2024, says that the policyholder can cancel his/her policy at any time, by giving seven days’ notice in writing. The insurer is required to refund the proportionate premium for the unexpired policy period.

Worried about premiums climbing steeply after you buy a policy? IRDAI decrees that premiums provided by insurers during their product filings cannot be changed for a period of three years after the product has been approved. Thereafter, the insurer may revise premium rates depending on the claims arising from the entire portfolio. An insurer cannot jack up your policy premium because of the claims you individually made. In motor insurance, many of us avoid filing for smaller claims to keep our premiums affordable. In health insurance, we need not do this, as our individual claims do not affect our premiums.

In addition, a January 2025 circular from IRDAI says that the premium on senior citizen policies cannot be hiked by more than 10 per cent a year.

Escape clause: An insurer can refuse to renew your policy if there is established fraud or non-disclosure or misrepresentation. Renewal can also be refused if the insurer has withdrawn the product and no longer sells it. In that case, you must be given suitable options to migrate.

Now that you know the law, if you think your insurer is violating them, file a written complaint with the insurer. Wait for 30 days. If you get no response, approach the Insurance Ombudsman by filing a complaint with all necessary documents, including your policy details, claim documents and communication with the insurer. The Ombudsman will investigate and may issue an award if a settlement is not reached.

The author is a Contributing Editor

Published on November 15, 2025